Also there are several sites like the parts store site a1 appliances sites and much more that guide when repairing this device. According to us bank, as of february 2015, alabama, indiana, nebraska. A few states require those inheriting accounts to submit tax waivers. New jersey property (such as real estate located in nj, nj bank and brokerage. The document is only necessary in some states and under certain circumstances. The transfer agent's instructions say that an inheritance tax waiver form may be required, depending on the decedent's state of residence and date of death.

Iowa, kentucky, maryland, nebraska, new jersey and pennsylvania tax people who receive inheritances, according to the american college of trust and. Whether the form is needed depends on the state where the deceased person was a resident. A few states require those inheriting accounts to submit tax waivers. Resume examples > form > inheritance tax waiver form puerto rico. The person who inherits the assets pays the inheritance tax. An inheritance tax waiver is form that may be required when a deceased person's shares will be transferred to another person. Because the irs will not allow a state death tax credit for deaths after jan. Missouri has no inheritance tax.

Some states restrict their uses or require specific estate executors use irs form 706:

This type of policy lasts a certain amount of time, and only pays out if you die within the stated period. Inheritance tax (iht) is a tax on the estate of someone who has died, including all property, possessions and money. The person who inherits the assets pays the inheritance tax. These where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2021. However, as of 2020, only six states impose an inheritance tax. The 2020 missouri state income tax return forms for tax year 2020 (jan. If you've inherited money from abroad, there may be inheritance tax on the estate of the deceased. These taxes are often acquired from the estate itself and are paid by the. An inheritance tax waiver is form that may be required when a deceased person's shares will be transferred to another person. Get the free illinois inheritance tax waiver form. 21 posts related to inheritance tax waiver form puerto rico. An inheritance tax requires beneficiaries to pay taxes on assets and properties they've inherited from someone who has died. An inheritance tax is a state tax that you pay when you receive money or property from the estate of a deceased person. Also, the united states also does not impose an income tax on inheritances brought into the united states.

Iowa, kentucky, maryland, nebraska, new jersey and pennsylvania tax people who receive inheritances, according to the american college of trust and. Required if decedent died before 1/1/81 and. Surviving spouses are exempt in all six states that collect an inheritance tax. New jersey property (such as real estate located in nj, nj bank and brokerage. These taxes are often acquired from the estate itself and are paid by the. An inheritance tax waiver is a document issued by the taxing authority like a state in order to prove that all inheritance taxes have been paid. I do not know its purpose. Six states collect a state inheritance tax as of 2021, and one of them—maryland—collects an estate tax as well.

If you've inherited money from abroad, there may be inheritance tax on the estate of the deceased.

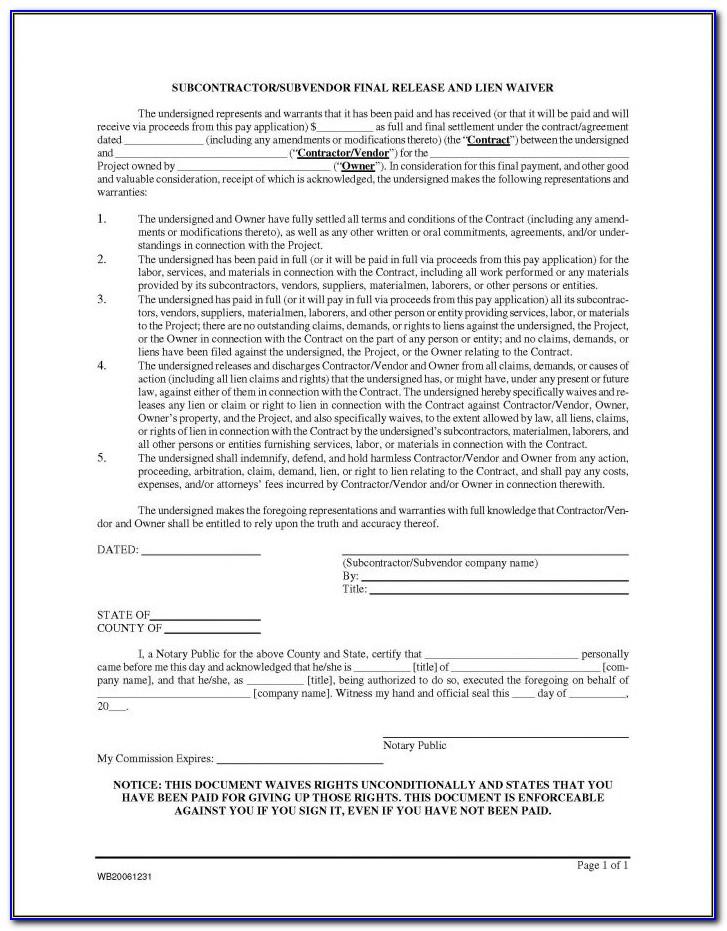

Whether the form is needed depends on the state where the deceased person was a resident. This guide to missouri lien waivers includes the rules, forms and more, to provide you with. Learn some potential inheritance tax implications and how you could save money when you repatriate your inheritance. Missouri requires statutory lien waiver form in specific circumstances. According to us bank, as of february 2015, alabama, indiana, nebraska. Being familiar with these terms might help as you transfer your loved one's account into your name. Mechanics lien rights can't be waived in in the state of missouri, lien waivers cannot be executed prior to, or in the contract for work. An inheritance tax requires beneficiaries to pay taxes on assets and properties they've inherited from someone who has died. Resume examples > form > inheritance tax waiver form puerto rico. Question four asks you to list beneficiaries of the estate and state their. These taxes are often acquired from the estate itself and are paid by the. To download tax forms on this site, you will need to install a free copy of adobe. (this form is for informational purposes only! I want to transfer ownership of some stock to his estate. If you've inherited money from abroad, there may be inheritance tax on the estate of the deceased.

Inheritance tax is a state tax on assets inherited from someone who died. Question four asks you to list beneficiaries of the estate and state their. Being familiar with these terms might help as you transfer your loved one's account into your name.

Surviving spouses are exempt in all six states that collect an inheritance tax.

A few states require those inheriting accounts to submit tax waivers. Required if decedent died before 1/1/81 and. Get the free illinois inheritance tax waiver form. Because the irs will not allow a state death tax credit for deaths after jan. These taxes are often acquired from the estate itself and are paid by the. There's normally no inheritance tax to pay if either This guide to missouri lien waivers includes the rules, forms and more, to provide you with. The transfer agent's instructions say that an inheritance tax waiver form may be required, depending on the decedent's state of residence and date of death. We'll help you determine whether your state requires a tax waiver and, if so, how to obtain one. Inheritance tax, sometimes confused with estate tax, is a tax on the beneficiaries/receivers of an estate (e.g since there are no missouri inheritance tax, you do not need to file any tax forms. After that, your tennessee form inheritance tax waiver 2013 2019 is ready. If you've inherited money from abroad, there may be inheritance tax on the estate of the deceased. Missouri has no inheritance tax. Surviving spouses are exempt in all six states that collect an inheritance tax. Tax resulting from the death transfer.

After that, your tennessee form inheritance tax waiver 2013 2019 is ready.

A few states require those inheriting accounts to submit tax waivers.

Question four asks you to list beneficiaries of the estate and state their.

The internet has become a tool a good choice for locating and looking out state of illinois inheritance tax waiver form.

Mechanics lien rights can't be waived in in the state of missouri, lien waivers cannot be executed prior to, or in the contract for work.

Also there are several sites like the parts store site a1 appliances sites and much more that guide when repairing this device.

The indiana department of revenue (dor) inheritance tax division works with individuals, tax professionals, assessors, attorneys, and financial institutions to understand what tax.

Get the free illinois inheritance tax waiver form.

Missouri requires statutory lien waiver form in specific circumstances.

Inheritance tax (iht) is a tax on the estate of someone who has died, including all property, possessions and money.

International tax law distinguishes between an estate tax and an inheritance tax—an estate tax is.

However, as of 2020, only six states impose an inheritance tax.

Inheritance tax is a tax on the estate (the property, money and possessions) of someone who's died.

Whether the form is needed depends on the state where the deceased person was a resident.

Iowa, kentucky, maryland, nebraska, new jersey and pennsylvania tax people who receive inheritances, according to the american college of trust and.

To download tax forms on this site, you will need to install a free copy of adobe.

New jersey also exempts surviving registered as civil union or domestic partners.

These taxes are often acquired from the estate itself and are paid by the.

However, as of 2020, only six states impose an inheritance tax.

Federal estate taxes, state estate taxes, and state inheritance taxes generally are due about nine state laws determine how a waiver works.

After that, your tennessee form inheritance tax waiver 2013 2019 is ready.

These taxes are often acquired from the estate itself and are paid by the.

Learn some potential inheritance tax implications and how you could save money when you repatriate your inheritance.

If you've inherited money from abroad, there may be inheritance tax on the estate of the deceased.

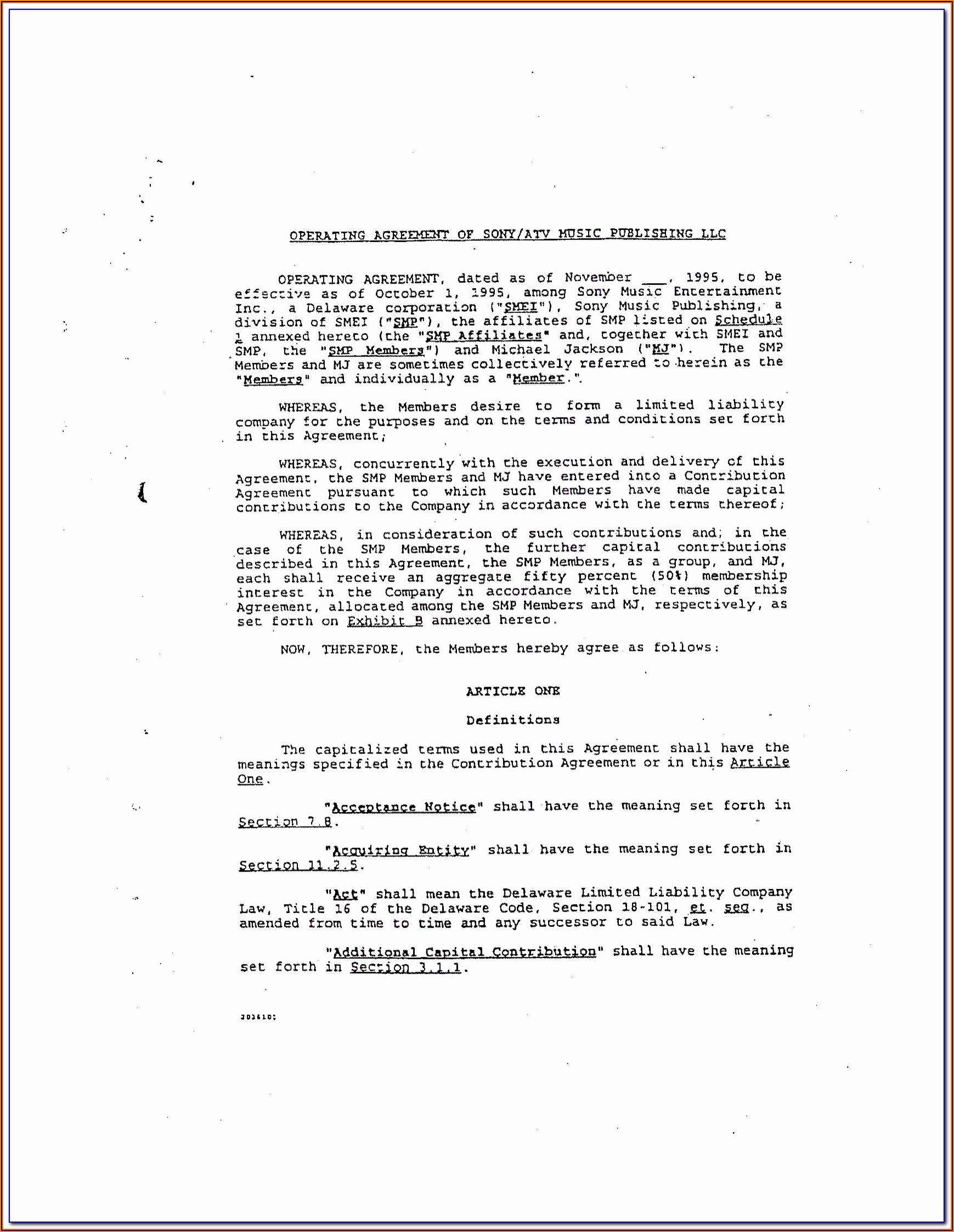

State inheritance tax waiver list the information in this appendix is based on information published as of june 27, 2005 in • missouri not required if decedent died after 1/1/81;

An inheritance tax requires beneficiaries to pay taxes on assets and properties they've inherited from someone who has died.

An inheritance tax waiver is a document issued by the taxing authority like a state in order to prove that all inheritance taxes have been paid.

Iowa, kentucky, maryland, nebraska, new jersey and pennsylvania tax people who receive inheritances, according to the american college of trust and.

Missouri requires statutory lien waiver form in specific circumstances.

This type of policy lasts a certain amount of time, and only pays out if you die within the stated period.

New jersey property (such as real estate located in nj, nj bank and brokerage.

Also, the united states also does not impose an income tax on inheritances brought into the united states.

New jersey also exempts surviving registered as civil union or domestic partners.

Inheritance tax is a tax on the estate (the property, money and possessions) of someone who's died.

0 Komentar